In my intro post, I mentioned that I have had other credit cards before – even travel cards. But the Chase Sapphire Preferred (CSP) was my first card I opened after joining the points & miles hobby. The CSP is frequently recommended as the best beginner card. There are a lot of things to consider when starting this hobby – timing, cost, earning points, spending points, and card benefits. I’ll try to go over those things in this post and why I agree that this is a great first card.

Timing – Since this is recommended as the first card, you don’t need to worry about the timing of any other cards. But you should know that timing is very important as you add other cards to your wallet. If you add too many other cards, then Chase will deny you for future cards. For example, if you quickly add an American Airlines card, JC Penney, Victoria Secrets, Hilton and Shell, then all of a sudden you have too many cards and will be declined by Chase. The Chase unwritten “rule” is you cannot have more than 5 personal credit cards in the past 24 months, commonly known as the 5/24 rule. So the idea is to pace yourself and work on the Chase cards prior to branching out to other brands. And if you are able to open business cards, do that first because that will not affect the 5/24 rule (for the most part – of course there are some exceptions).

Cost – The CSP has an annual fee of $95. To me, that seemed high since so many cards have no annual fee (AF). But the no AF cards don’t have all of the other perks and benefits that the cards with fees have. You will just need to compare what the benefits are and whether you will use enough to offset the annual fee. As an example, the Chase Sapphire Reserve (CSR) has an AF of $550. One of the many differences between these two cards – the CSP has a $50 travel credit, the CSR has a $300 travel credit. And the CSR comes with Priority Pass membership ($469 value) and Global Entry/TSA Precheck reimbursement (up to $100). So if you will use the added benefits for the CSR, then maybe that should be your first card.

Earning Points – The typical way to earn points is by using your credit card. The amount of points per dollar earned varies based on card and type of purchase. Since we are discussing the CSP, let’s look more at how to earn points with this card. The CSP earns Ultimate Rewards (UR) points. You will earn 3 points per dollar when you eat at restaurants or do online grocery shopping (excludes Walmart/Target) and streaming services (Netflix, Peacock, etc.). You will earn 2 points per dollar on travel expenses (airfare, car rentals, hotels). But the biggest point earner is just by opening the card! When I post this, the current sign-up bonus (SUB) is 60,000 points. In order to earn a sign-up bonus, you must spend a certain amount of money (also known as minimum spend) on a credit card in a prescribed amount of time. This particular card is $4,000 in 3 months. This may sound like a lot – but think of how much you spend on groceries, auto insurance, fuel, etc. And then you also get points for referring other people to the card. I am attaching a link – I’d appreciate the support!

Earn 60,000 bonus points with either Chase Sapphire card. I can be rewarded if you apply here and are approved for the card.

https://www.referyourchasecard.com/19o/2WI3C1W3NV

Spending Points – Chase UR points can be cashed out for cash at the rate of $1 – 100 points. That is great…but there are much more lucrative redemptions available. The most bang for your buck is to transfer points to travel partners. Chase is affiliated with 3 hotel chains and multiple airlines so you can transfer points directly to your rewards account for the partner and use the points directly on that website. For example, Hyatt hotels is one of Chase’s hotel partners. I have opened a membership rewards account. I was going to a concert in Tulsa and found that Hyatt Regency was within walking distance to the concert venue. That particular hotel had a points redemption of 5,000 points for a room. If I would have booked that hotel with cash, it would have been $350 the night of the concert! So if I would have cashed out points for cash, it would have taken 35,000 points to cash out $350. But I was able to transfer 5,000 points and get that same hotel room. Another way to use points is to book travel through Chase Travel. This would be similar to booking trough Expedia or Booking.com. It is safe, but if there is a problem, you have to go through this third party travel agency to work through the problem as opposed to going directly to the hotel or airline. With the CSP using Chase Travel, a $100 charge would cost 8,000 points. So your points go 25% further than just cashing out points directly. You can also use your Ultimate Rewards to purchase gift cards … but just like cash, the transfer rate is $1 = 100 points. They occasionally have sales, but usually only 10% discount, so $1 = 90 points.

Here is a list of Chase Ultimate Rewards transfer partners:

Card Benefits – Credit cards come with many benefits, so it’s important to read your terms and conditions when you receive a new card. Some of the benefits associated with the CSR are outlined below:

- Trip Cancellation Insurance – If your trip is cancelled or cut short by sickness, severe weather and other covered situations, you can be reimbursed up to $10,000 per person and $20,000 per trip for your pre-paid, non-refundable travel expenses, including passenger fares, tours, and hotels.Trip Cancellation Insurance

- Trip Delay Reimbursement – If your common carrier travel is delayed more than 12 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket.

- Baggage Delay Insurance – Reimburses you for essential purchases like toiletries and clothing for baggage delays over 6 hours by passenger carrier up to $100 a day for 5 days.

- Auto Rental Collision Damage Waiver – Decline the rental company’s collision insurance and charge the entire rental cost to your card. Coverage is primary and provides reimbursement up to the actual cash value of the vehicle for theft and collision damage for most rental cars in the U.S. and abroad.

- $50 annual Chase Travel hotel credit – Earn up to $50 in statement credits each account anniversary year for hotel stays purchased through Chase Travel.

- 5x points on Chase Travel purchases – Purchase your next trip through Chase Travel and earn 5x total points on flights, cruise lines, hotels, car rentals and more.

- Complimentary DashPass Membership – With DashPass, you’re saving on delivery fees on eligible orders from DoorDash and Caviar.

- 5x on Lyft rides – Earn an additional 3X points plus the 2X points you already earn on travel.

- No Foreign Transaction Fees

- Purchase Protection – Covers your new purchases for 120 days against damage or theft up to $500 per claim and $50,000 per account.

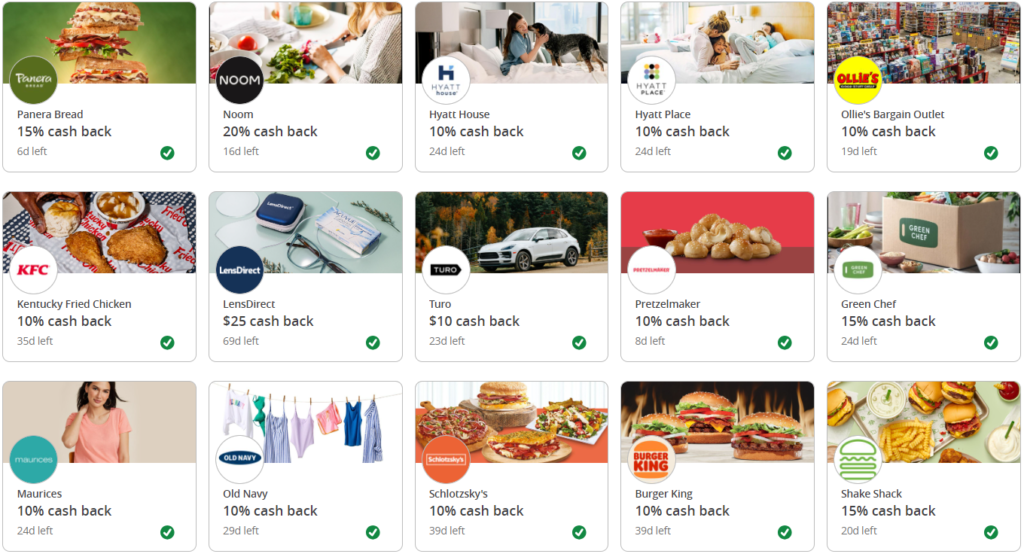

One of my favorite benefits is Chase Offers! This may go back to my couponing days, but with each Chase card you have they have a group of discounts available to you when you use your card. 15% back on Panera, 10% back at Ollie’s, etc. But you need to sign in and enroll in the offer to receive the rebate. I have earned $140 in the past year using these offers.

In closing, I do agree that the Chase Sapphire Preferred is a great beginner card. It’s easy to earn points and it’s easy to redeem points! And I have used it already several times to get great rates on hotel stays and transferred to Southwest Airlines for a trip, too!

Leave a comment below if you’d like to ask any questions or make suggestions!

Glossary / Acronyms:

AF – Annual Fee

CSP – Chase Sapphire Preferred

CSR – Chase Sapphire Reserve

SUB – Sign-up Bonus

UR – Ultimate Rewards